Implied Volatility Chart

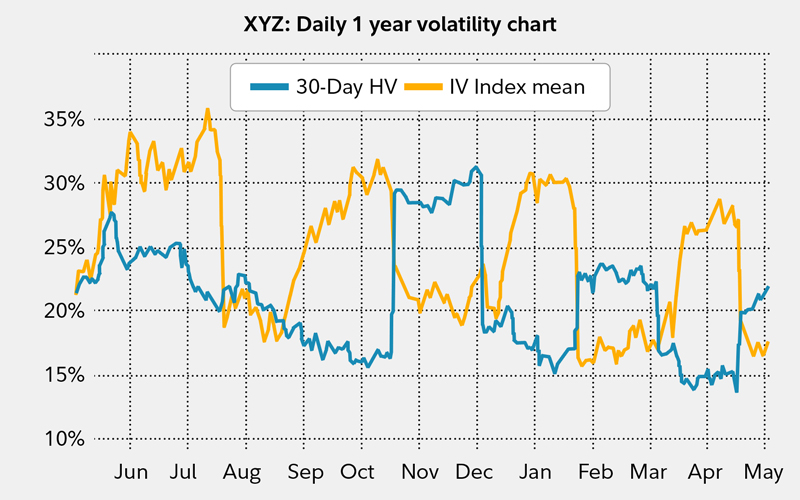

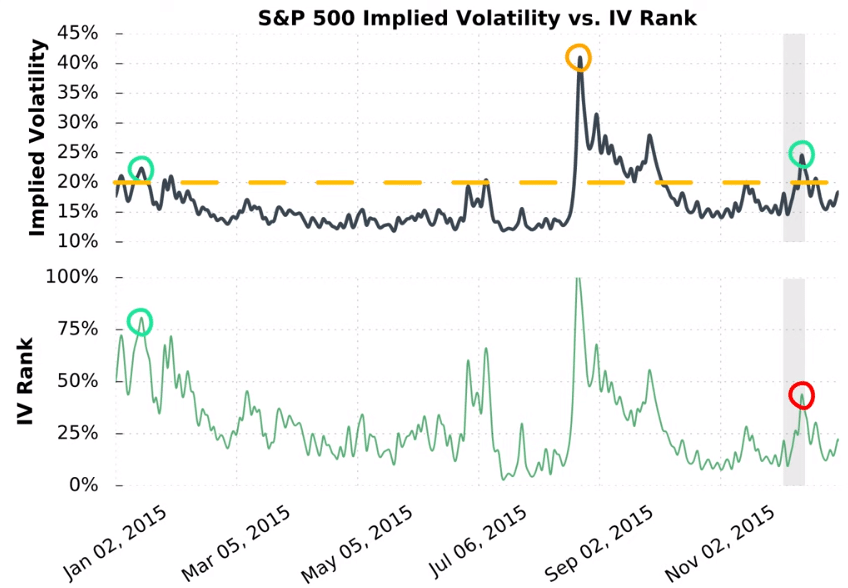

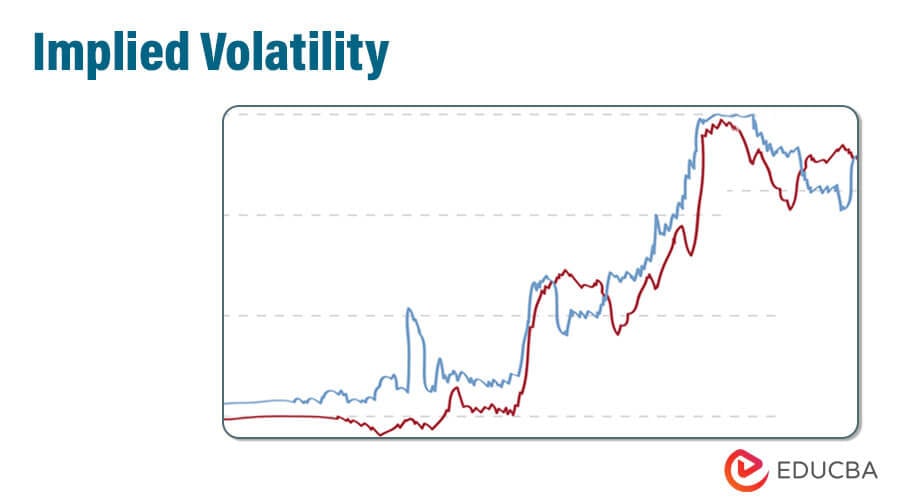

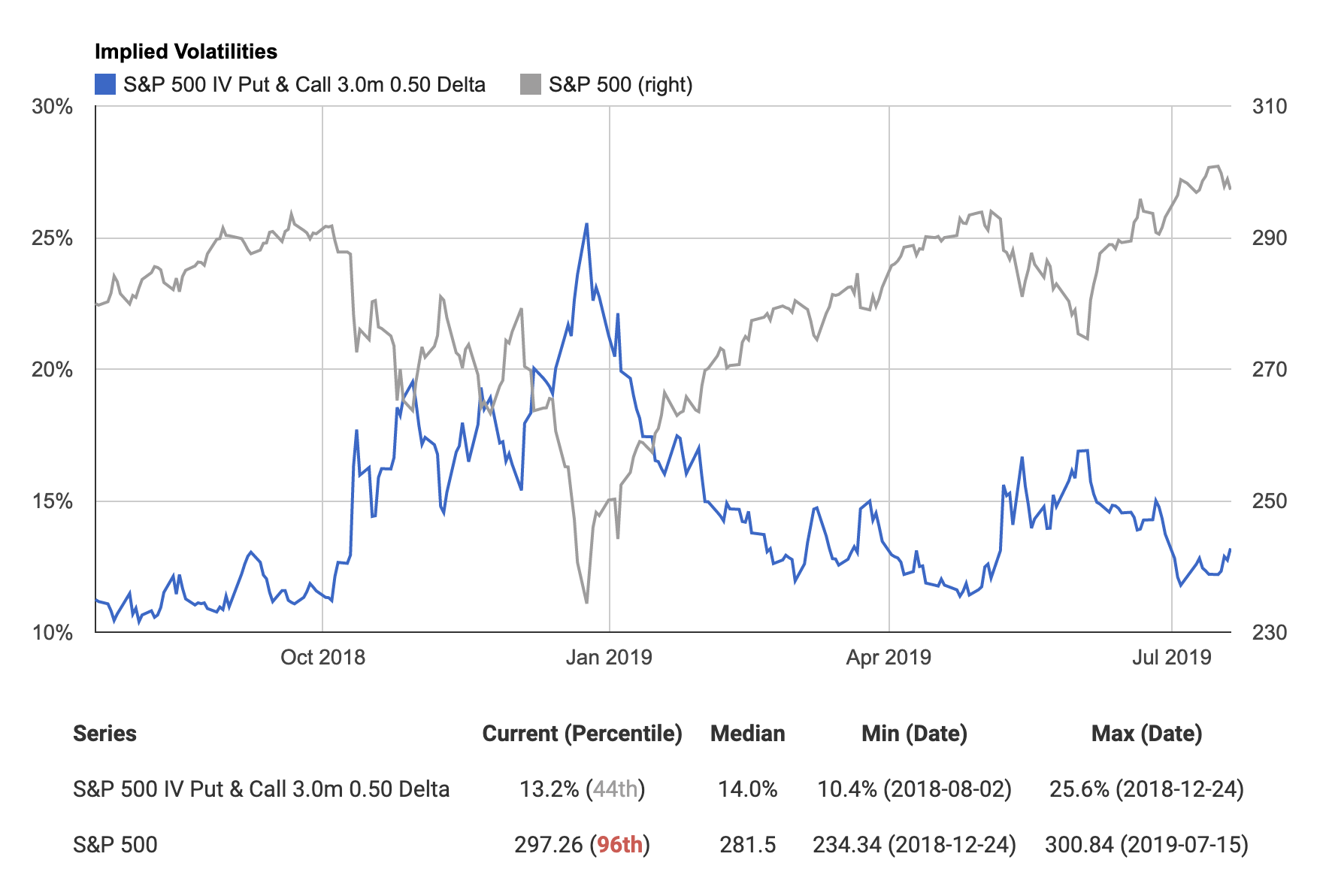

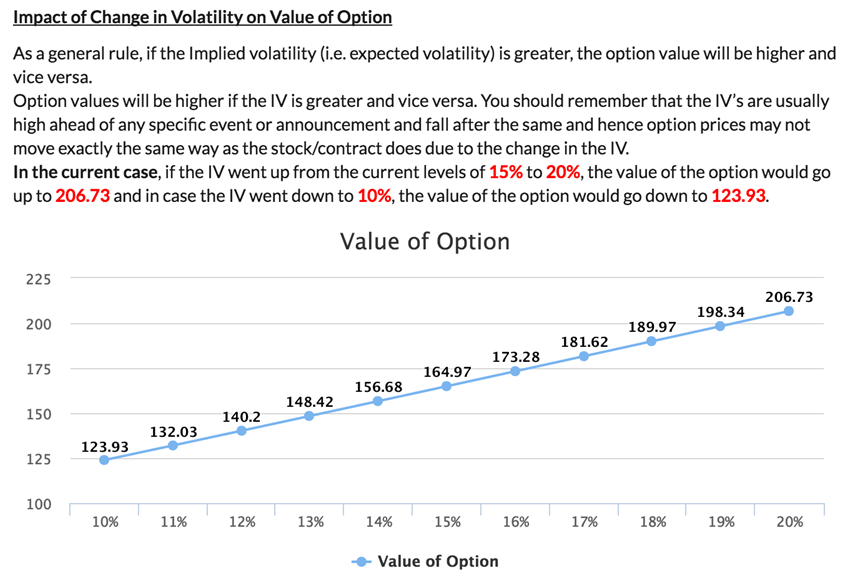

Implied Volatility Chart - Web traders can pull up an implied volatility chart to see iv on different time frames. See open interest of options and futures, long/short build up, max pain, pcr, iv, ivp and volume over time. Implied volatility rises and falls, affecting the value and price of. Our charting tools contain over 10 years of historical data for you to leverage to uncover investment opportunities. American express ( axp ), comerica ( cma ), euronet worldwide. Web learn the difference between implied and historical volatility and find out how to align your options trading strategy with the right volatility exposure. Web implied volatility shows how much movement the market is expecting in the future. Luckily, hahn tech developed a method for doing just this. Web options volatility and implied earnings moves today, july 19, 2024. In other words, an asset's. Overlay and compare different stocks and volatility metrics using the interactive features. Implied vs historical volatility comparison indicator (monthly and yearly) i was frustrated with tos that when i combined the iv indicator with hv indicators onto the same chart, the scaling would never align correctly for easy comparisons. Market volatility is defined as a statistical measure of an asset's deviations from a set benchmark or its own average performance. In other words, an asset's. T oday, several major companies are expected to report earnings: You see, an option’s market value is determined in part. Web severity of price fluctuation. As expectations change, option premiums react appropriately. Web learn the difference between implied and historical volatility and find out how to align your options trading strategy with the right volatility exposure. Web view volatility charts for apple (aapl) including implied volatility and realized volatility. A green implied volatility means it is increasing compared to yesterday, and a red implied volatility means it is decreasing compared to yesterday. Overlay and compare different stocks and volatility metrics using the interactive features. Our charting tools contain over 10 years of historical data for you to leverage to uncover investment opportunities. Web view volatility charts for apple (aapl). Get the real time chart and historical implied volatility charts. Web market chameleon's implied volatility rankings report shows a detailed set of data for stocks, comparing their current implied volatility to historical levels. Abbott laboratories (abt), cintas (ctas), dr horton (dhi), domino’s pizza (dpz), infosys (infy), intuitive surgical (isrg. Implied volatility (iv) is like gravity. Web our chart tool enables. Web traders can pull up an implied volatility chart to see iv on different time frames. Options with high levels of implied volatility suggest that investors in the underlying stocks are expecting a big. American express ( axp ), comerica ( cma ), euronet worldwide. Web shows stocks, etfs and indices with the most option activity on the day, with. Web implied volatility is a metric used by investors to estimate a security’s price fluctuation (volatility) in the future and it causes option prices to inflate or deflate as demand changes. Web market chameleon's implied volatility rankings report shows a detailed set of data for stocks, comparing their current implied volatility to historical levels. Web implied volatility, on the other. Web severity of price fluctuation. Our charting tools contain over 10 years of historical data for you to leverage to uncover investment opportunities. Our platform allows you to flexibly chart historical implied volatilities, realized volatilities, and skews across global asset classes in seconds. You can find symbols that have currently elevated option implied volatility, neutral, or subdued. Web implied volatility,. Abbott laboratories (abt), cintas (ctas), dr horton (dhi), domino’s pizza (dpz), infosys (infy), intuitive surgical (isrg. Often labeled as iv for short, implied. Traders use iv for several reasons. Web implied volatility, synonymous with expected volatility, is a variable that shows the degree of movement expected for a given market or security. Web shows stocks, etfs and indices with the. In other words, an asset's. T oday, several major companies are expected to report earnings: Market volatility is defined as a statistical measure of an asset's deviations from a set benchmark or its own average performance. See open interest of options and futures, long/short build up, max pain, pcr, iv, ivp and volume over time. Web traders can pull up. As expectations change, option premiums react appropriately. Web shows stocks, etfs and indices with the most option activity on the day, with the atm average iv rank and iv percentile. Our platform allows you to flexibly chart historical implied volatilities, realized volatilities, and skews across global asset classes in seconds. Web implied volatility is a metric used by investors to. Implied volatility shows how the. Previously, these strategies were marketed as defensive equity but more recently have picked up a new marketing spin: Implied vs historical volatility comparison indicator (monthly and yearly) i was frustrated with tos that when i combined the iv indicator with hv indicators onto the same chart, the scaling would never align correctly for easy comparisons.. Web implied volatility is a statistical measure of the expected amount of price movements in a given stock or other financial asset over a set future time frame. From the charts tab, enter a symbol. You may also choose to see the lowest implied volatility options by selecting the appropriate tab on the page. Web view volatility charts for spdr. Get the real time chart and historical implied volatility charts. Overlay and compare different stocks and volatility metrics using the interactive features. T oday, several major companies are expected to report earnings: Options with high levels of implied volatility suggest that investors in the underlying stocks are expecting a big. Implied vs historical volatility comparison indicator (monthly and yearly) i was frustrated with tos that when i combined the iv indicator with hv indicators onto the same chart, the scaling would never align correctly for easy comparisons. Web today, several major companies are expected to report earnings: Web traders can pull up an implied volatility chart to see iv on different time frames. Web implied volatility is a statistical measure of the expected amount of price movements in a given stock or other financial asset over a set future time frame. Our platform allows you to flexibly chart historical implied volatilities, realized volatilities, and skews across global asset classes in seconds. Web implied volatility, on the other hand, is the estimate of future (unknown) price movement that is reflected in an option’s price: Web implied volatility represents the expected volatility of a stock over the life of the option. Web view volatility charts for apple (aapl) including implied volatility and realized volatility. Options with high levels of implied volatility suggest that investors in the underlying stocks are expecting a big. Web implied volatility (iv) charts for nifty and banknifty. You can find symbols that have currently elevated option implied volatility, neutral, or subdued. American express ( axp ), comerica ( cma ), euronet worldwide.Implied volatility Fidelity

Implied Volatility Chart Thinkorswim

Implied Volatility Explained (The ULTIMATE Guide) projectfinance

Implied Volatility Options Chart

Options Trading Implied Volatility, Chart Matrix, and Options Greek

Complete Guide to Options Pricing Option Alpha

What Is Implied Volatility? IV Options Explained, 45 OFF

Implied Volatility Charting · Volatility User Guide

Implied Volatility Basics, Factors & Importance Chart & Example

Implied Volatility What is it & Why Should Traders Care?

Web Implied Volatility Shows How Much Movement The Market Is Expecting In The Future.

Web Severity Of Price Fluctuation.

Web The Highest Implied Volatility Options Page Shows Equity Options That Have The Highest Implied Volatility.

Often Labeled As Iv For Short, Implied.

Related Post: