Credit Spreads Chart

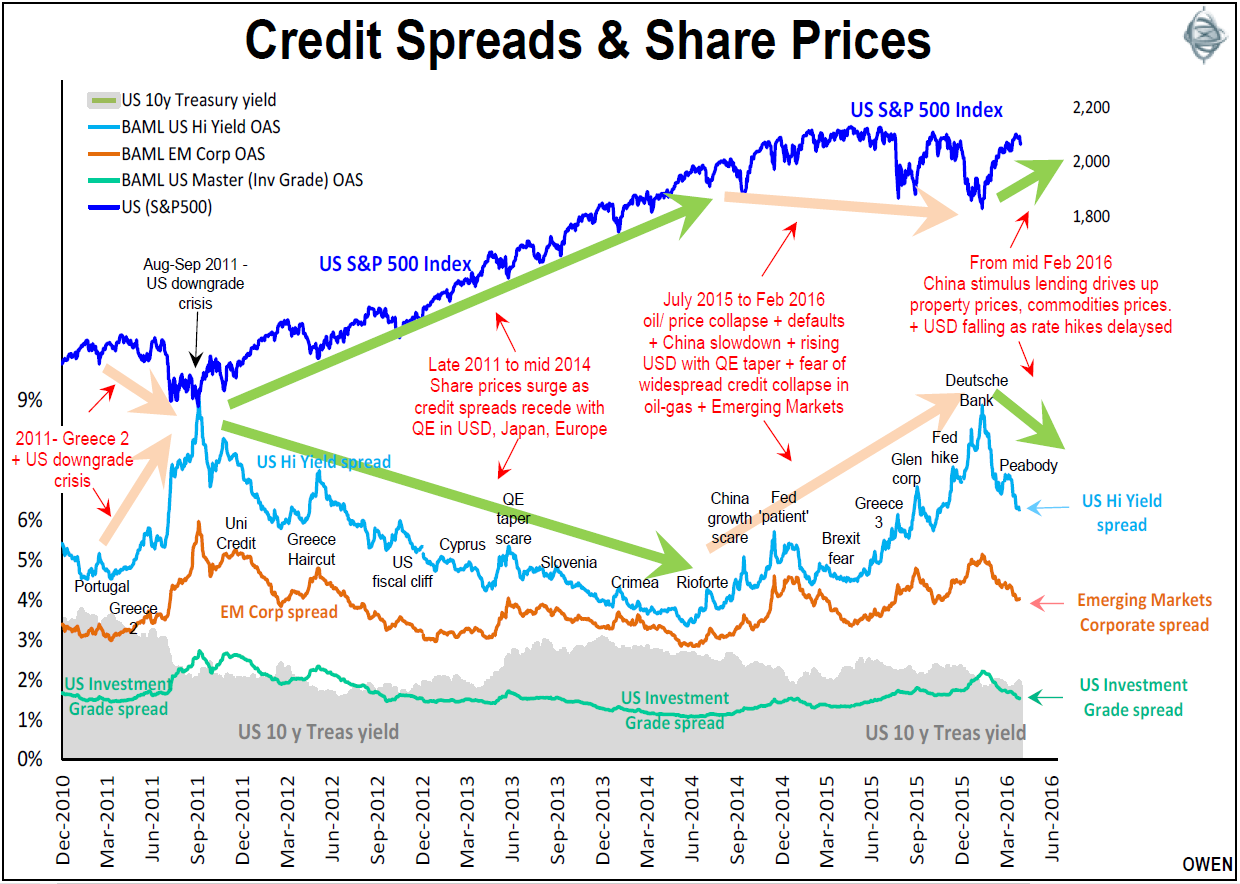

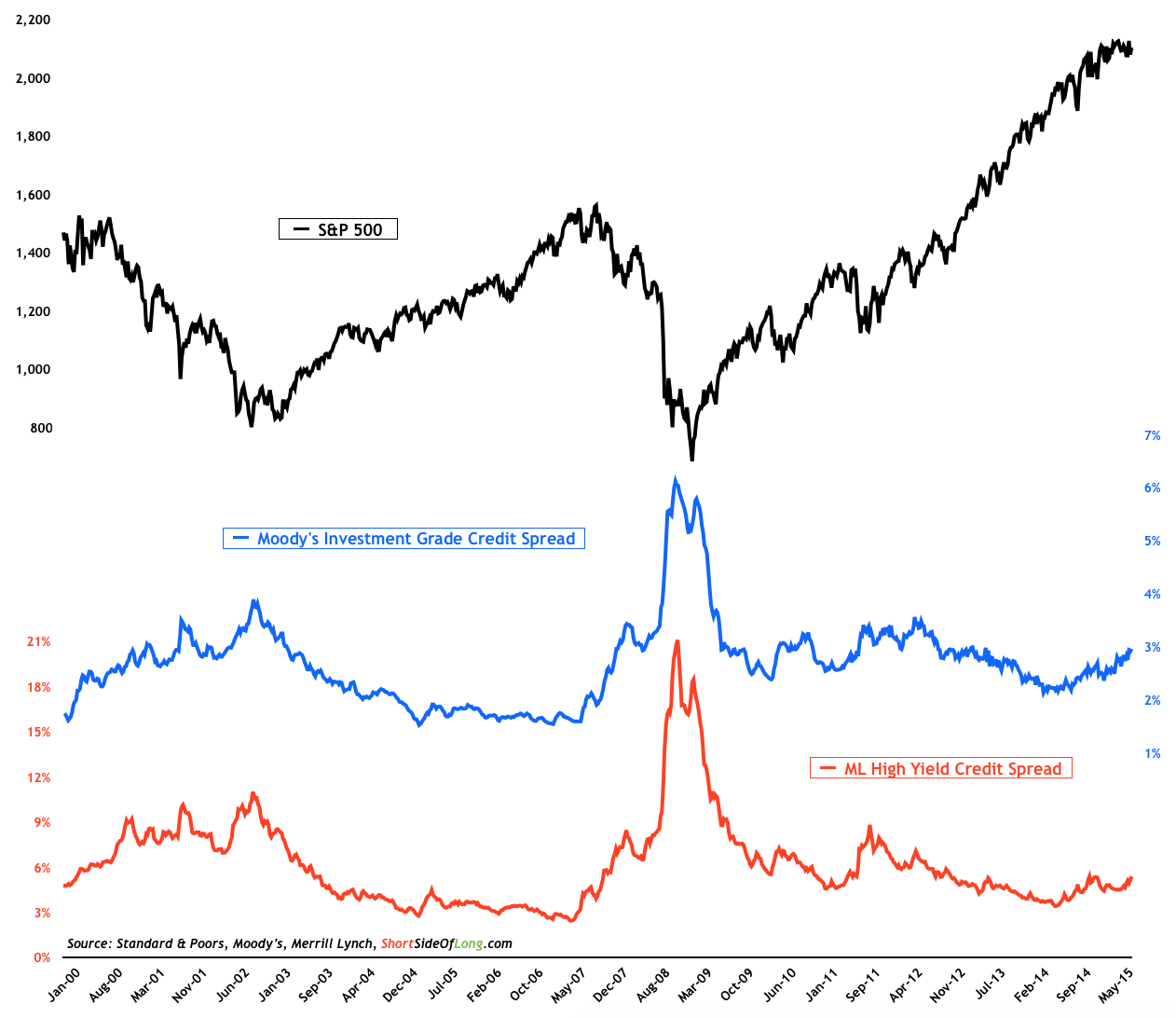

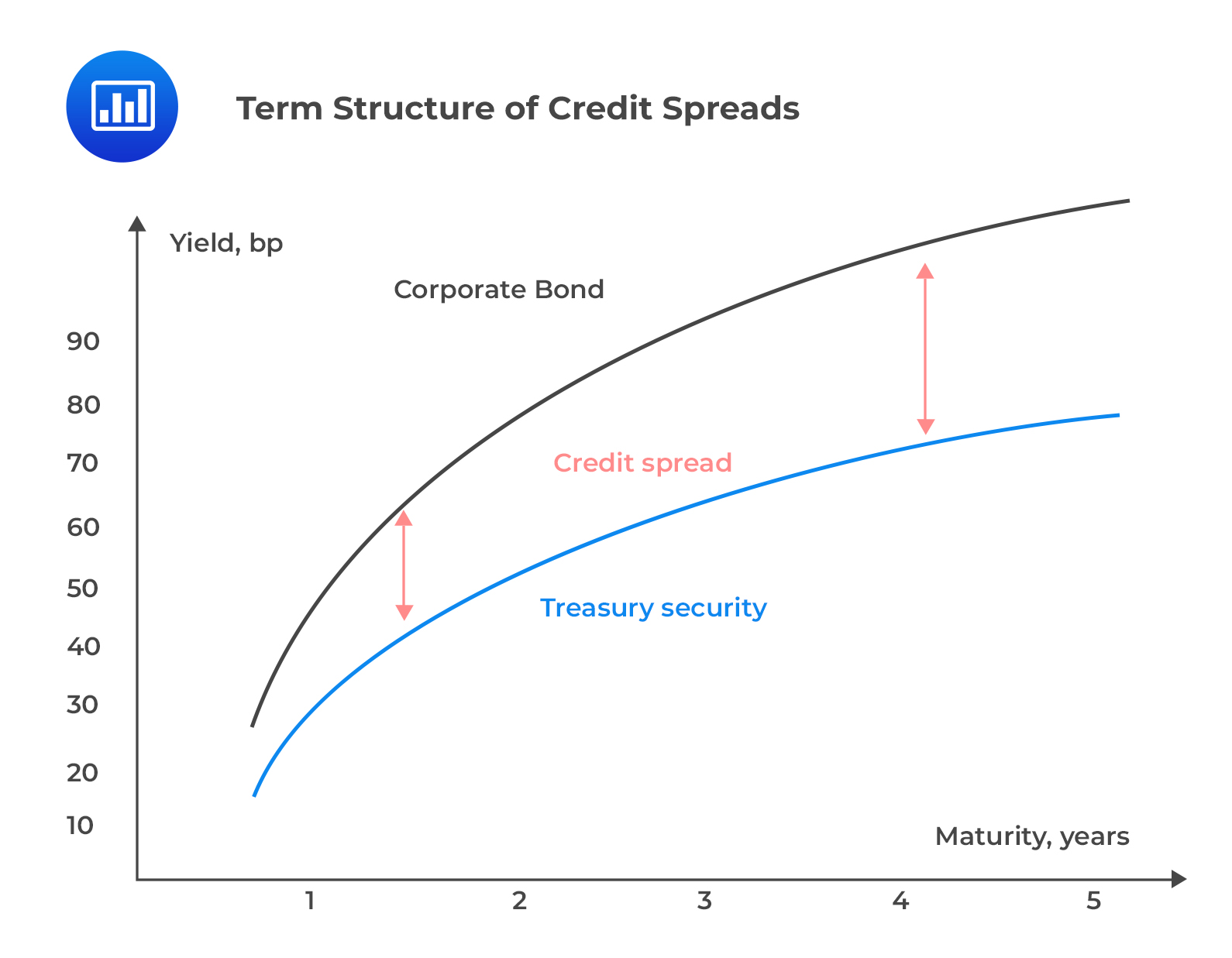

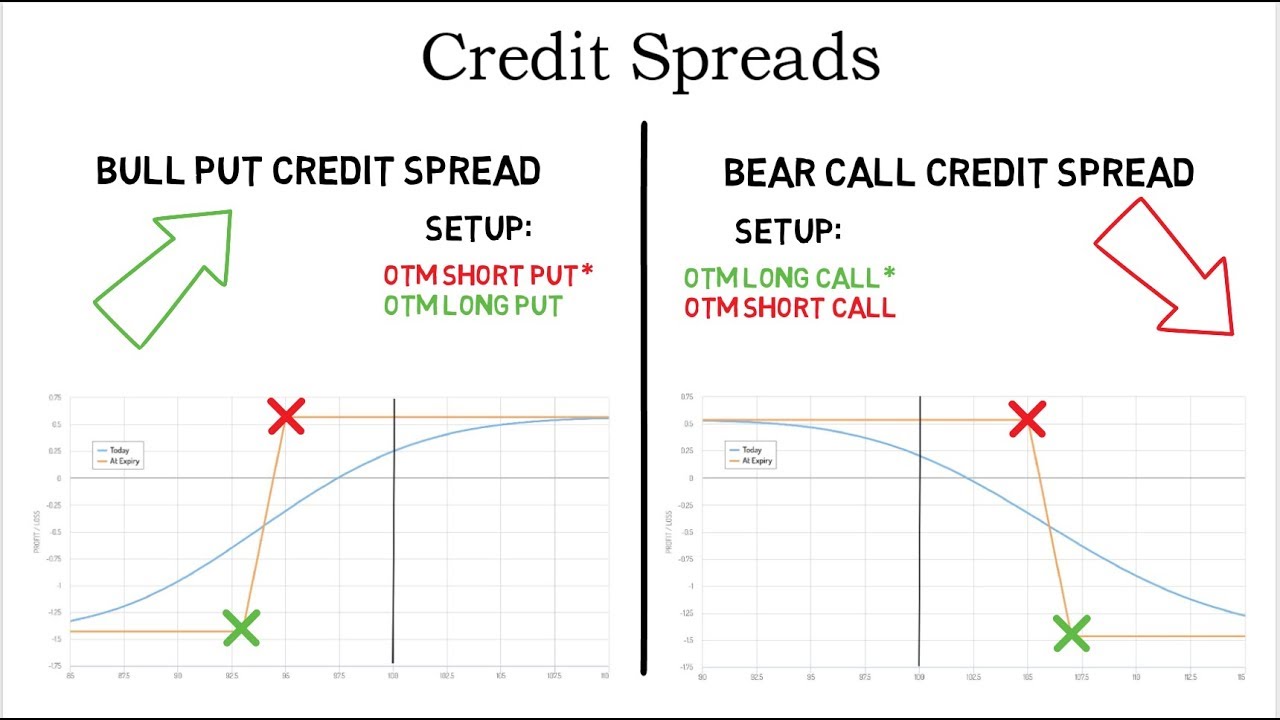

Credit Spreads Chart - Download, graph, and track economic data. Web cybersecurity firm crowdstrike suffered a major outage on friday, the company told nbc, impacting businesses globally. When analyzing credit spreads, all we’re doing is measuring the difference in yield between a. The outage resulted from an issue. Web credit spreads involve the simultaneous purchase and sale of options contracts of the same class (puts or calls) on the same underlying security. Web the credit risk spread has a negative correlation with the stock market. It's a crucial economic indicator, and also refers to. Web credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity (ytm) and the ytm of a us treasury bond or note. Web 740 to 799: Learn why they matter, how to read. Web ditch the confusion! This is lower than the. It's a crucial economic indicator, and also refers to. When the spread widens, stock prices are likely to decline. Web cybersecurity firm crowdstrike suffered a major outage on friday, the company told nbc, impacting businesses globally. Web 740 to 799: In the case of a vertical. The outage resulted from an issue. Web compare the yield spreads between corporate bonds, treasury bonds, and mortgages with long maturities. Individuals in this tier have a positive, above average credit history, and are likely to have an easier time securing credit. The outage resulted from an issue. Web the credit risk spread has a negative correlation with the stock market. Download, graph, and track economic data. Web the higher your score, the better. Web a credit spread is the gap between the interest rate offered to investors by a u.s. Web when there’s stress on risk assets, it shows up in credit spreads. The american economy has held up well against. Web the higher your score, the better. In the case of a vertical. The fico model of credit scoring puts credit scores into six categories: Web credit spreads involve the simultaneous purchase and sale of options contracts of the same class (puts or calls) on the same underlying security. The flags mark the beginning of a recession according to wikipedia. See how credit spreads change over time and reflect the credit risk and. Download, graph, and track economic data. Web the credit risk spread has. The us credit spread includes us aaa credit. Web credit spreads involve the simultaneous purchase and sale of options contracts of the same class (puts or calls) on the same underlying security. The american economy has held up well against. Web the credit risk spread has a negative correlation with the stock market. See how credit spreads change over time. Web cybersecurity firm crowdstrike suffered a major outage on friday, the company told nbc, impacting businesses globally. Treasury bond versus another debt security with the same maturity. Web a credit spread is the gap between the interest rate offered to investors by a u.s. Interest rate spreads, 36 economic data series, fred: Web the credit risk spread has a negative. This is lower than the. Web the credit risk spread has a negative correlation with the stock market. It's a crucial economic indicator, and also refers to. Individuals in this tier have a positive, above average credit history, and are likely to have an easier time securing credit. Web compare the yield spreads between corporate bonds, treasury bonds, and mortgages. The flags mark the beginning of a recession according to wikipedia. This is lower than the. Web a credit spread reflects the difference in yield between a treasury and corporate bond of the same maturity. The us credit spread includes us aaa credit. It's a crucial economic indicator, and also refers to. Interest rate spreads, 36 economic data series, fred: Web credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity (ytm) and the ytm of a us treasury bond or note. It's a crucial economic indicator, and also refers to. Web 740 to 799: Web when there’s stress on risk assets, it shows up. Web view data of the spreads between a computed index of all bonds below investment grade and a spot treasury curve. The outage resulted from an issue. Interest rate spreads, 36 economic data series, fred: Web cybersecurity firm crowdstrike suffered a major outage on friday, the company told nbc, impacting businesses globally. The fico model of credit scoring puts credit. Web years of higher inflation and interest rates have left consumers mired in debt, even as overall economy hums. Web this download contains the latest credit spread fed data for the credit spread regression process. The flags mark the beginning of a recession according to wikipedia. When analyzing credit spreads, all we’re doing is measuring the difference in yield between. In the case of a vertical. Web years of higher inflation and interest rates have left consumers mired in debt, even as overall economy hums. When analyzing credit spreads, all we’re doing is measuring the difference in yield between a. Web credit spreads involve the simultaneous purchase and sale of options contracts of the same class (puts or calls) on the same underlying security. Web credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity (ytm) and the ytm of a us treasury bond or note. Web compare the yield spreads between corporate bonds, treasury bonds, and mortgages with long maturities. The us credit spread includes us aaa credit. Web this download contains the latest credit spread fed data for the credit spread regression process. Web the credit risk spread has a negative correlation with the stock market. Download, graph, and track economic data. The flags mark the beginning of a recession according to wikipedia. Web a credit spread is the gap between the interest rate offered to investors by a u.s. Treasury bond versus another debt security with the same maturity. It's a crucial economic indicator, and also refers to. The fico model of credit scoring puts credit scores into six categories: Web when there’s stress on risk assets, it shows up in credit spreads.Credit Spread Options Strategies (Visuals and Examples) projectfinance

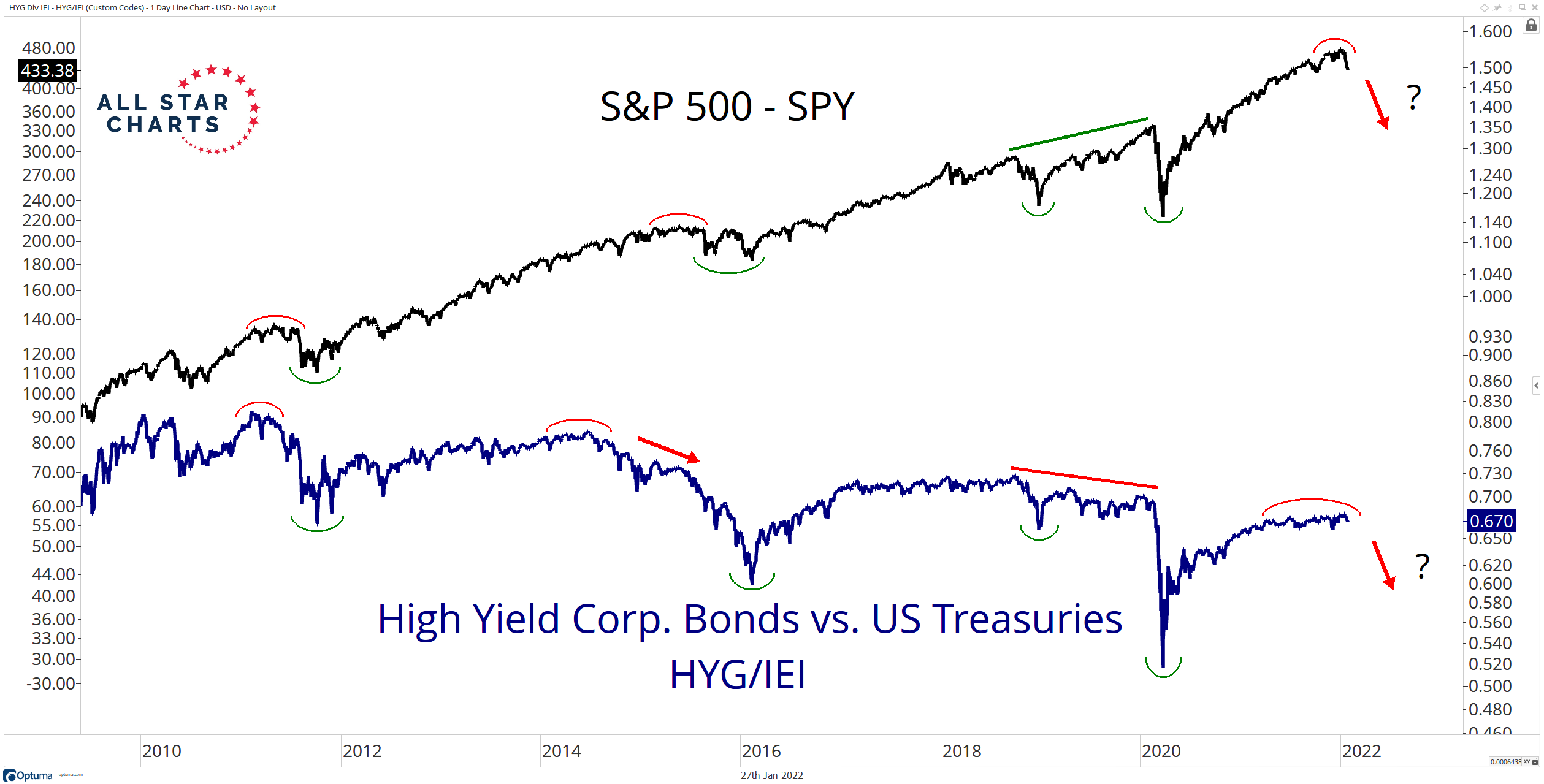

What credit spreads reveal about share markets

Credit Spreads Continue To Rise Seeking Alpha

Term Structure of Credit Spreads CFA, FRM, and Actuarial Exams Study

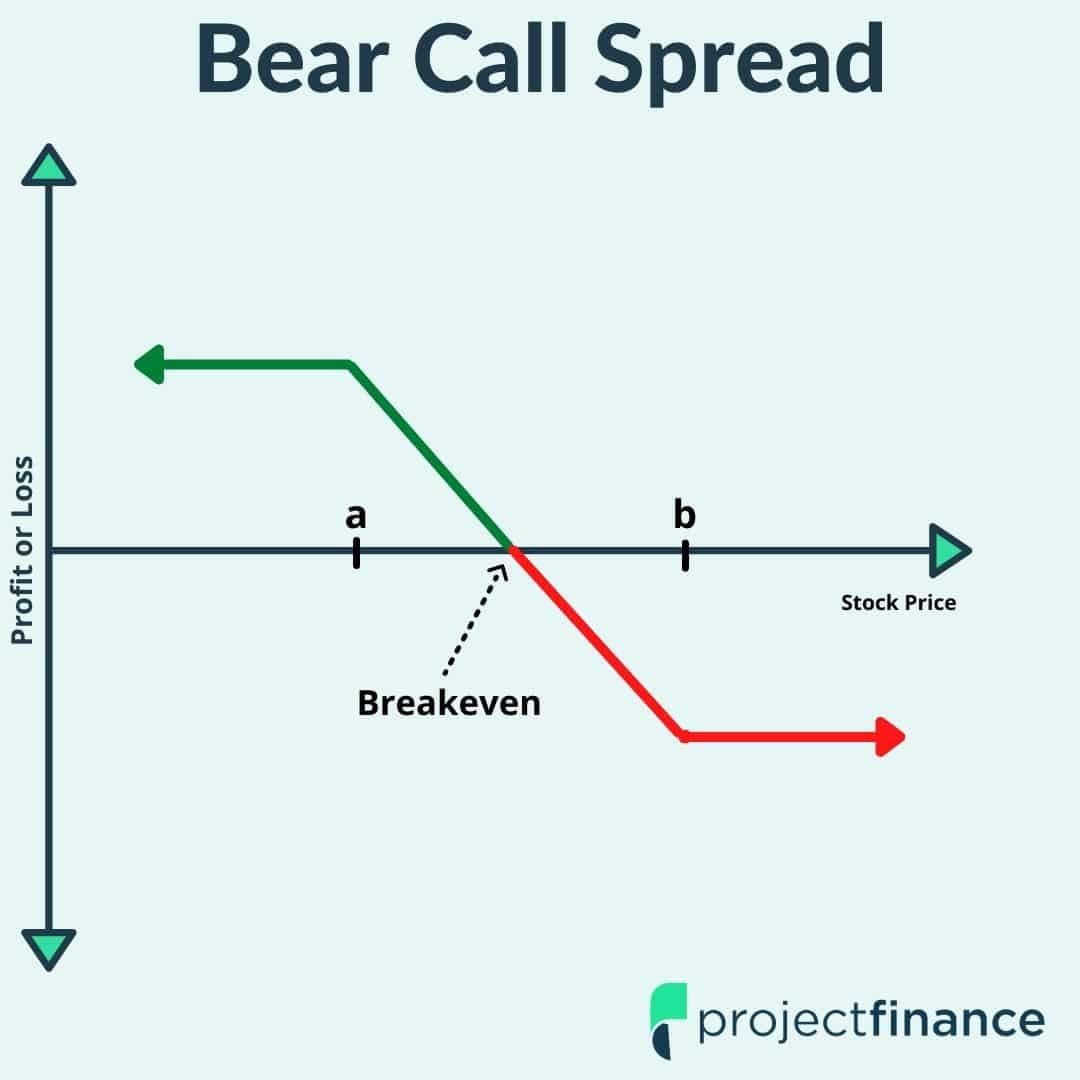

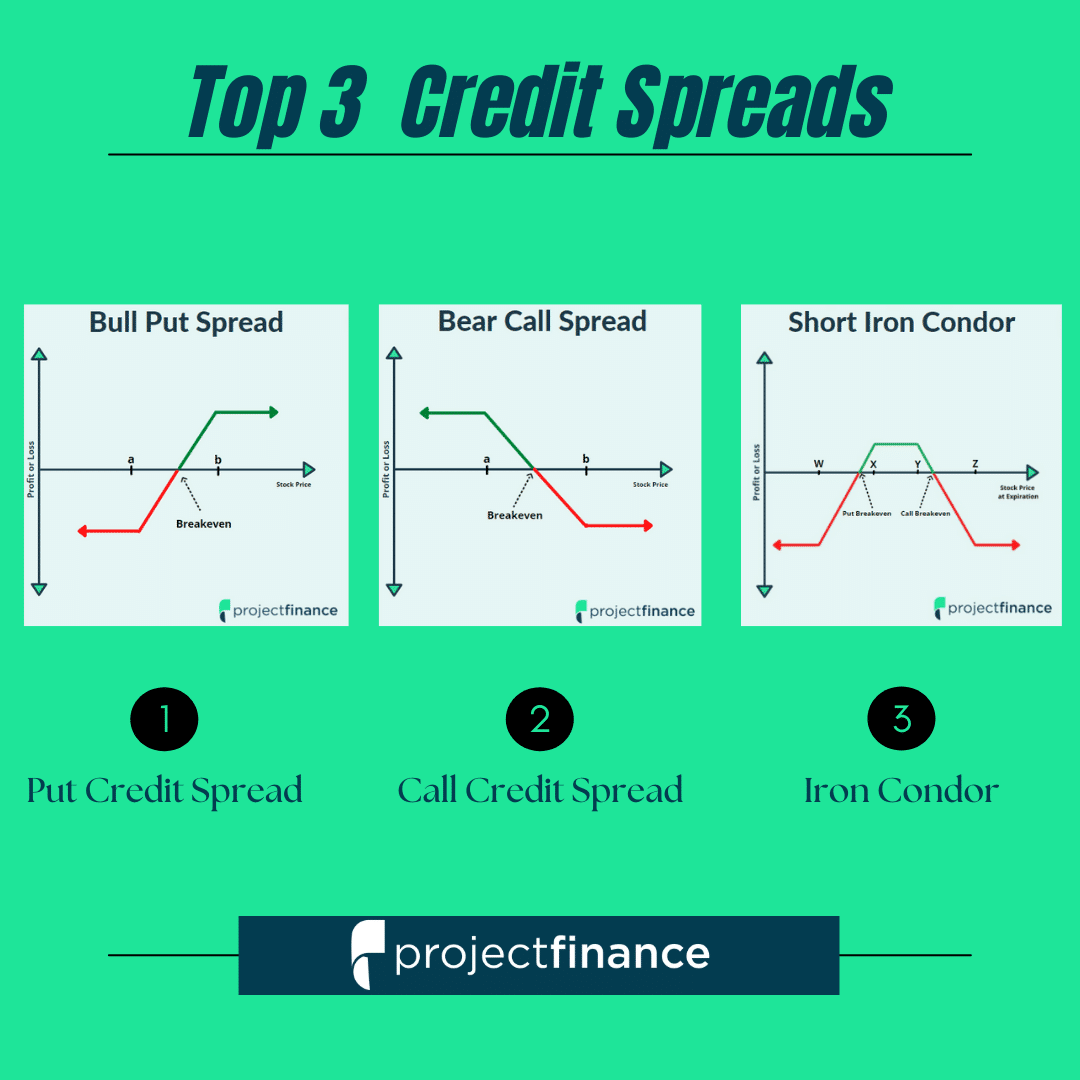

3 Best Credit Spread for Options Strategies projectfinance

LongTerm Credit Spread Chart September 12, 2016

a US Dollar corporate credit spreads by rating. b US Dollar corporate

Option Credit Spreads Explained with examples YouTube

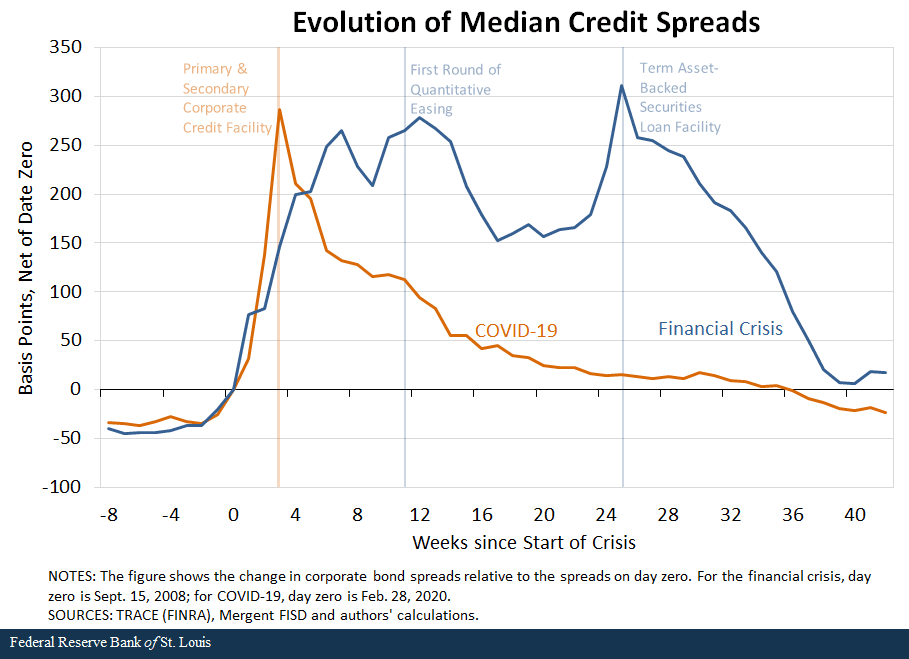

Credit Spreads, Financial Crisis and COVID19 St. Louis Fed

Breaking Down Credit Spreads All Star Charts

The Outage Resulted From An Issue.

Web View Data Of The Spreads Between A Computed Index Of All Bonds Below Investment Grade And A Spot Treasury Curve.

The American Economy Has Held Up Well Against.

Web Ditch The Confusion!

Related Post: